Homeowners contemplating a home sale sometimes find themselves wondering if their credit may suffer from the transaction. As homeowners navigate the intricate path of selling their property, they often encounter the pressing question, “Does selling a house affect my credit?” The labyrinth of real estate transactions, coupled with the complexity of credit score considerations, can indeed take time to decipher. However, gaining clarity on this subject is pivotal. Armed with accurate knowledge, homeowners can better understand the implications of their decisions on their financial health and credit standing. The aim is to shed light on the relationship between home sales and credit scores, bringing transparency to an otherwise ambiguous topic.

Direct Influence of Home Sales on Credit Scores

Homeowners contemplating a home sale sometimes find themselves wondering if their credit may suffer from the transaction. As homeowners navigate the intricate path of selling their property, they often encounter the pressing question, “Does selling a house affect my credit?” The labyrinth of real estate transactions, coupled with the complexity of credit score considerations, can indeed take time to decipher. However, gaining clarity on this subject is pivotal. Armed with accurate knowledge, homeowners can better understand the implications of their decisions on their financial health and credit standing. The aim is to shed light on the relationship between home sales and credit scores, bringing transparency to an otherwise ambiguous topic.

Direct Influence of Home Sales on Credit Scores

It’s essential to grasp that selling a home does not directly influence your credit score. Credit bureaus, the entities responsible for calculating credit scores, include the likes of Equifax, Experian, and TransUnion. They employ established models like FICO or VantageScore to determine creditworthiness based on several financial factors. Interestingly, the sale of a home isn’t one of them.

In essence, the process of selling a house doesn’t inherently possess a built-in mechanism that directly affects credit scores. This lack of direct impact stems from the fact that credit bureaus are primarily interested in your behavior regarding credit repayment and the management of debt. Selling a property is, after all, a transaction that doesn’t inherently denote any information about these aspects of your financial behavior.

Impact of Mortgage Loan Payoff

However, selling a home may indirectly influence your credit score through mortgage loans. A mortgage is, in most cases, the most substantial loan people take on in their lives. Therefore, it significantly contributes to the credit history aspect of your credit score. If you sell your home and settle your mortgage loan, this loan account closes on your credit report.

A balanced mix of active credit types, including installment loans like mortgages, enhances your credit score. This concept of ‘credit mix’ accounts for approximately 10% of your FICO score. Therefore, paying off a mortgage and closing the account could lead to a slight dip in your credit score. This dip in credit score should not be a deterrent from selling your home as other aspects of your financial behavior continue to contribute to credit score rebuilding. However, note that the impact is typically short-term and recovers over time as other active credits contribute positively.

The Role of Payment History

A substantial portion of your credit score stems from your payment history. This record accounts for approximately 35% of your FICO score, emphasizing its importance. It’s tempting to overlook the regular payments when you’re in the process of selling, but doing so can lead to late payments or, worse, missed payments. It is crucial that you maintain punctual payments for your mortgage loan during the selling process.

Both late and missed payments can impact your score negatively and can remain on your credit report up to seven years. Even as you navigate through the process of selling your house, vigilance in adhering to your payment schedule protects your credit rating. This protective measure ensures your credit score remains unscathed, irrespective of the outcome of the home sale.

Home Sale and Future Borrowing Capability

Selling a house can indirectly influence your creditworthiness and borrowing capacity in the future. The proceeds from a home sale can significantly contribute to paying off other debts. This payoff subsequently reduces your credit utilization ratio – the amount of the credit you use relative to the total credit available to you. This ratio is a crucial factor considered by lenders and contributes to 30% of your FICO score.

Successfully managing the proceeds from your home sale could mean an enhanced credit score and better chances of securing future loans. A lower credit utilization ratio is beneficial for your credit score and, by extension, your future borrowing capabilities. This indirect influence of a home sale on your credit score might seem peripheral, but it has substantial implications for your financial health.

Mortgage Prepayment and Your Credit Score

Paying off your mortgage early might be a double-edged sword for your credit score. On the one hand, successfully closing a significant debt reflects well on your credit history, especially if you’ve made all payments on time. However, there’s another facet to consider. If your mortgage was your only installment loan, paying it off could potentially impact your credit mix — a factor that makes up part of your credit score.

While the weightage of credit mix in determining your credit score is relatively small (10% of your FICO score), it’s still worth considering, especially if you’re planning to apply for significant credit like a mortgage or auto loan in the near future. A diverse credit mix — a combination of installment loans, credit cards, and retail accounts — is perceived as a positive signal by credit scoring models, indicative of your experience in managing different types of credit.

The Interplay of Debt-to-Income Ratio

Another vital factor that indirectly links the sale of your home to your credit is your debt-to-income ratio (DTI). While this ratio isn’t a part of your credit score calculation, it plays a substantial role in your ability to qualify for new credit. Lenders often evaluate this ratio to assess your ability to manage monthly payments and repay borrowed money.

Selling your home and subsequently paying off your mortgage reduces your debt obligations, thereby improving your DTI. An improved DTI can enhance your chances of securing a loan with favorable terms, such as lower interest rates, even though it may not directly influence your credit score.

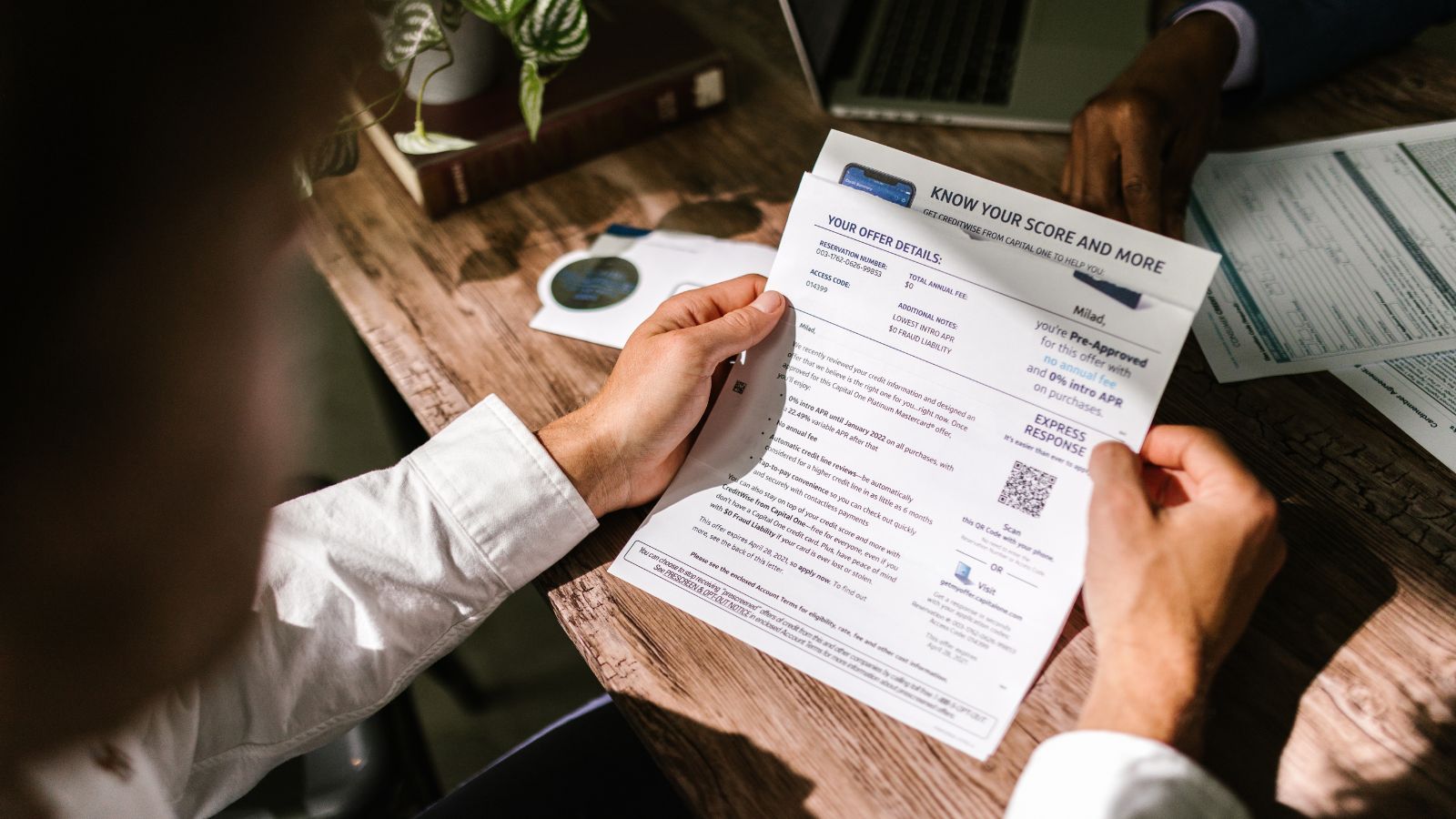

Proactive Credit Monitoring

In the dynamic process of selling your home and managing the finances involved, keeping a close eye on your credit report is paramount. Regular monitoring enables you to ensure all information is accurate and updated promptly, especially details regarding mortgage payments. If you spot any errors, dispute them immediately to prevent any undue adverse impact on your credit score.

Conclusion

The sale of a home and its impact on your credit score is a nuanced issue shaped by multiple indirect factors rather than a direct correlation. As a homeowner planning to sell, a deep understanding of these intricacies can equip you to make informed decisions that safeguard your financial and credit health.