Once you’ve decided to own a home, one of the first things that you should do is examine your finances. Unless you can afford to pay for a house up front, you should start saving right away. A home is an expensive but important investment in your future.

You’ll have to save for a down payment, which is usually around 20 percent of the total sale price of a home.

There will also be other charges that you’ll be responsible for, such as closing costs and any applicable transfer taxes or fees. Once you’ve moved in, there will be monthly expenses such as association dues if you live in a townhome or condo and utility bills.

Buying a home in California isn’t always easy. Pay attention to market trends. Determine how much you can afford and start looking at neighborhoods that you’d like to live in. You can still accomplish your goal with proper planning and budgeting.

Here are some of the more common utilities for a house:

1. Recycling and waste pickup.

Homeowners have to pay for garbage and recycling pickups. You may have two to three recycling bins, depending on the services and the requirements in your area.

You’ll probably have a bin for paper products and another for plastic, glass or other recyclable items made from clear materials. You may even have separate bins for lawn waste and other organic items or just a general garbage can.

Garbage and recycling rates are typically set by the city government. There may be several companies to choose from, so ask around and get some price comparisons before contracting with a specific firm.

2. Gas and electricity.

Natural gas is used to heat your home. Electricity powers your refrigerator, microwave, television, lamps, and other items. Gas and electric bills are usually assessed monthly by your respective providers.

You can ask what providers the previous home owners used and feel free to comparison shop before selecting the right companies for you.

Just make sure that you get these services added or transferred over to your name either before you move in or shortly after.

Down Payment When Buying a House

3. Sewer and water.

Sewer and water utilities are operated by the public utilities commission in your city or area.

All water usage in your home, from bathing and showers to water used for cooking, flushing toilets and waste water is included.

These charges are based on the amount of water used every month and the meter at your residence.

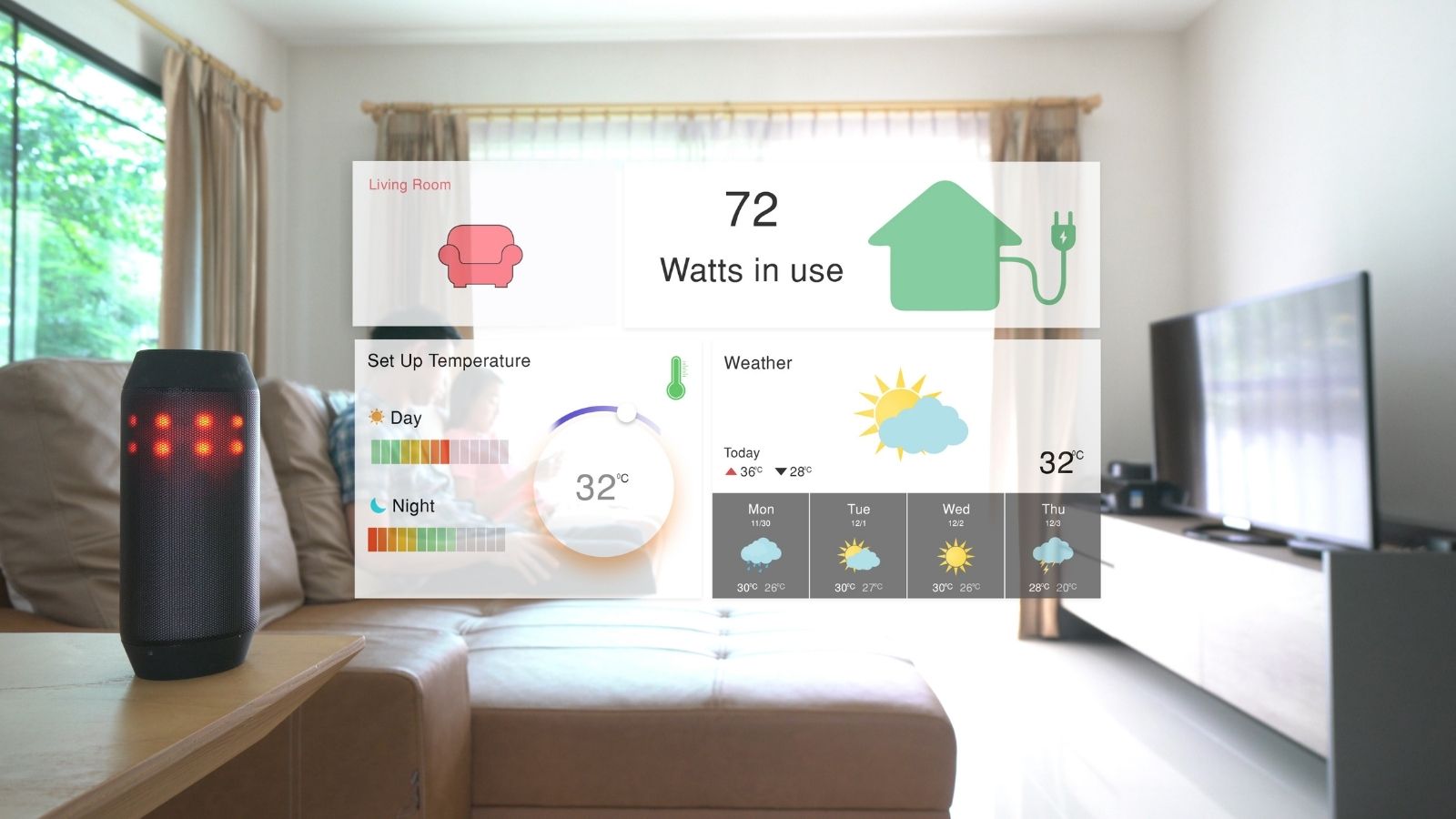

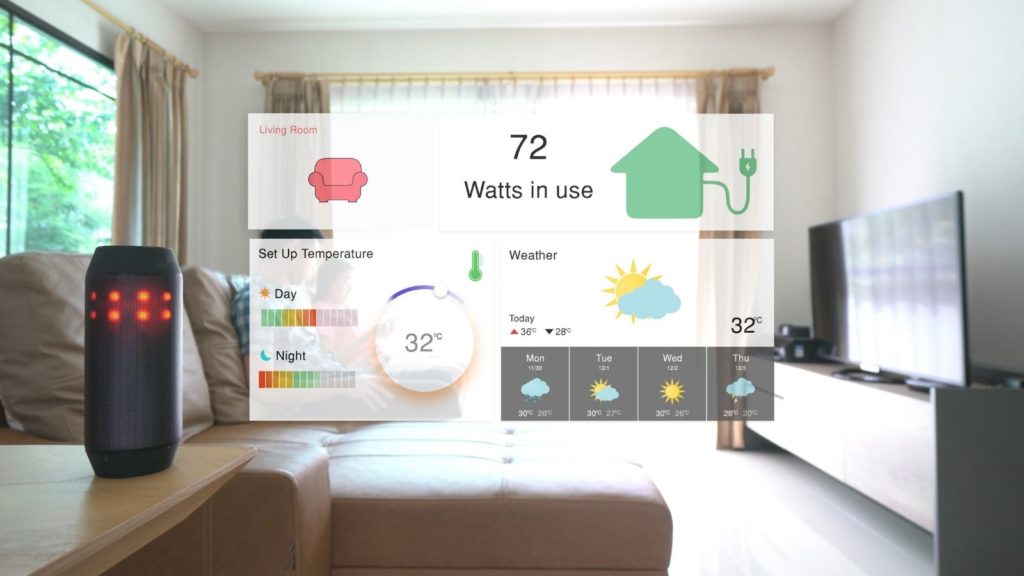

4. Technology.

Technology utilities are traditionally optional charges. Cable or satellite television, Internet connections and phone lines are some examples of these types of utilities.

The charges will vary by month and type of service. You may be able to purchase some of these services (telephone, internet, television, etc.) from the same company.

Monthly Utility Costs

Total monthly utility costs can vary greatly, depending on where you live and the time of year.

For example, people who live in colder climates tend to spend more money on natural gas and other heating costs during the winter than those living in warmer locales.

On the other hand, homeowners in hotter climates usually pay more for electricity and other utilities associated with cooling costs annually than those who only have to worry about air conditioning in the spring and summer months.

The average utility bills for homeowners are generally around $300 to $600 or more per month. Here’s an estimated monthly breakdown by category:

- Recycling & waste = $15.00

- Natural gas = $75.00

- Sewer & water = $75.00

- Electricity = $120.00

- Internet & television (technology services) = $150.00

Monthly Utility Tips

If you’re concerned about your monthly utility bills, here are a few things that you can do to reduce those expense

1. Buy a programmable thermostat.

Programmable thermostats are relatively inexpensive. You can purchase a quality model for around $200 or less. They can be used to reduce the temperature in your home at night or when you’re away. You can also lower the temperature in rooms that are used less frequently.

2. Seal any gaps.

After you’ve moved in, take some time to examine the doors and windows in your home. If you notice any cracks or gaps, make sure to seal them right away. They can bring additional hot or cold air into your home, depending on the time of year. Properly sealing those areas can help you save significantly on your energy bills.

What Credit Score is Needed to Buy a House?

3. Use electricity wisely.

Turn off any lights that aren’t currently being occupied. Unplug your television, lamps and other appliances when they’re not in use or if you’re going on vacation. Pay attention to how you use electricity in your home.

You shouldn’t need to have multiple devices in multiple rooms across your home on a regular basis. Only using electricity on important appliances and other items as they’re needed can really pay off in the long run.

4. Turn the water heater down.

Another way to save is by adjusting your water heater to a lower setting. You can still take showers and baths and run water for cooking and cleaning.

You can still have clean dishes from running your dishwasher after using a reduced temperature on your water heater.

5. Pay attention to appliance energy ratings.

When shopping for new appliances, take a few minutes to read the energy efficiency ratings. Yellow Energy Guide tags are placed on many new dishwashers, refrigerators and water heaters.

The information on these tags will tell you how energy efficient the particular product is in comparison to other comparable models. Some appliances may have an Energy Star logo. This logo means that the product has met federal energy efficiency guidelines.

6. Add power strips.

A good way to save on electrical costs is by plugging your computer, television, DVD player and other commonly used devices that use electricity into power strips.

You’ll use less electricity by using the same power strip for multiple devices. You’ll also free up outlet space around your home.

What Does It Cost To Buy A House?

7. Use a low-flow shower head.

Low flow showerheads are worth considering if you use a lot of water or if your shower is used regularly. They can be purchased for around $50 or less. These types of showerheads aerate water. They also use less water overall.

8. Clean your appliances regularly.

Simple tasks like replacing air filters or removing sediment from your water heater can help to extend the useful life of these and other appliances.

Cleaning air ducts as well as your refrigerator, stove, microwave, freezer and dishwasher can make these items last longer and operate more efficiently.

You can follow the recommendations from your user manuals or set your own schedule to inspect and maintain these items several times a year.

9. Run the dishwasher only when it’s full.

Most modern dishwashers use the same amount of water, no matter how full or empty your dishwasher load is.

Waiting to run your dishwasher until it’s full saves water and energy. You’re using fewer resources less frequently while you save on energy costs at the same time.

What Does Buying A House “As Is” Mean?

Conclusion

These are just some common-sense solutions to reducing your monthly utility bills. Installing low-flow toilets and using energy-efficient lightbulbs are some other examples.

After you’ve been in your home for a few months, you can review your utility bills to get a good idea of how much you should expect to set aside for these costs.

You can also look for ways to reduce these monthly expenses. Utilities are just part of a homeowner’s responsibilities. They’re necessary for maintaining the quality of life standards in the place that you should be very proud to call home.

📞 Have Questions? Ask The Chris Eckert Real Estate Team

Give The Chris Eckert Real Estate Team a call today at 650.627.3799 to learn more about local areas, discuss selling a house, or tour available homes for sale.