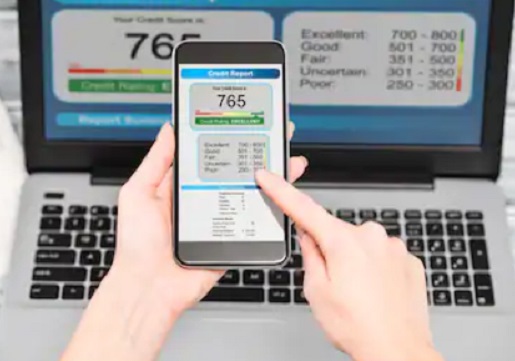

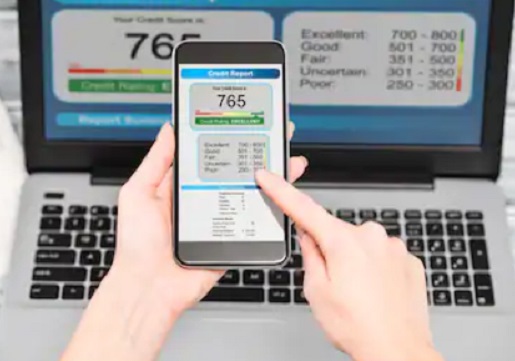

Because credit scores are a number, it often seems that there should be a cut and dry answer to what credit score you need when buying a home in California. There are actually many elements that affect what score you will need in order to buy a home and get the best interest rate possible.

Let’s take a closer look at how credit scores are considered, what loan options there are, and what scores you might need to buy the home of your dreams.

How Your Credit Score is Considered by Mortgage Lenders

Before looking at the credit score range, it’s important to understand how lenders look at your mortgage application. When you understand the lenders’ process, you’ll have an easier time finding the best deal when buying a home in California.

The first thing to know is that lenders set their own criteria for what credit score they require to accept your mortgage application. When there are many people in your region buying homes with strong applications, applicants with decent criteria may be turned down when they could have been accepted if the market was different.

Keep this in mind when you hear stories from friends about what their application was like when they applied and what interest rates they were offered. Comparing with others is good information to have, but your feedback will vary.

You need to be informed on what to expect and do your best to get your application in the best shape possible, but you will not have firm answers on what interest rates you’ll be offered, or if you’ll be approved until you begin talking to loan officers and applying.

When lenders look at your application, they are considering multiple factors. While your credit score is an important one, so is your employment history, your income, your debt to income ratio (DTI), and your down payment.

If you apply for a mortgage and have a high credit score, a solid DTI, but your income doesn’t represent someone who would be able to make the mortgage payments you’re applying for, it will be hard to convince someone to give you a mortgage. Likewise, an excellent income with a very low credit score will have a difficult time.

| Browse by Location | |

| Homes under $600K | Homes under $700K |

| Homes under $800K | Homes under $900K |

| Homes under $1 Million | Homes over $1 Million |

The Average Scores for California Home Buyers

The average credit score for a home buyer in the United States is 684, but for first-timers buying a home in California, the average credit score is 701. In Fremont and San Francisco, California that average goes up to 753. The California market is a bit more competitive than other states.

While the average is high, you can still buy a home with a lower score if other areas of your application can help make you more desirable as an applicant. For example, having a larger down payment can make a big difference in this area.

Related: Steps to Take When Buying a Home in San Mateo, CA

What Credit Score Is Needed

When you are applying for a conventional mortgage, you generally need a credit score of at least 620. Be aware this is a low range and you will need to make up for that number with other strong factors on your application.

If you apply for an FHA loan, which is backed through a government program, your credit score can be as low as 500, though it becomes a lot more likely with a credit score over 580.

When your score is in the 500-579 range, you will be required to have a 10% down payment. With a score of over 580, you can be approved for an FHA loan with a down payment as low as 3.5%.

Veterans, surviving spouses, and active members of the military can apply for VA loans. These loans are known for offering more competitive interest rates and they offer you the option to buy a home with no down payment or mortgage insurance. These factors often make them the most affordable option.

There is no minimum credit score requirement when you apply for a VA loan. That being said, the lenders are often looking for a score of 640 or higher for a VA loan.

In the state of California, you are considered a first time home buyer if you haven’t owned or occupied your own home in the previous three years.

If you qualify as a first time home buyer, you may be eligible for one of the CalHFA programs.

These programs offer options for low down payments and help with closing cost assistance. In these programs, you usually need a credit score of 640 or higher. There may be some exceptions made if you’re close, so it’s worth contacting the CalHFA programs to learn more about your options.

Related: How to Find Down Payment Assistance Programs

Improve Your Credit Score

The higher your credit score, the lower your interest rate will likely be. If you are working toward buying a home, you will want to do your best to get the highest credit score you can and have a healthy down payment saved. These are two parts of your application that will help make your loan more affordable for you in the long run.

Develop a regular habit of checking your credit score. You can do this online for free and many credit card companies offer you a free service to keep a close watch on your credit.

Paying down your debts is always the strongest thing you can do to improve your score. In general, you want your debt to be below 30% of the credit you have available to you. So if you have a credit card with a $10,000 limit, you want to keep your balance below $3,000, if you are carrying a balance at all.

You can always contact a financial advisor to go over your finances and develop a personalized plan for improving your standing. It is also an option to contact a mortgage loan officer and consult them on your situation to see where you stand.

The Path to Home Ownership

Between closing costs, interest rates, down payments, and mortgage insurance, the path to homeownership can be costly.

The better your credit score the better you’ll be able to keep those costs down and find an affordable loan that will help you move into the California home of your dreams.

📞 Have Questions? Ask The Chris Eckert Real Estate Team

Give The Chris Eckert Real Estate Team a call today at 650.627.3799 to learn more about local areas, discuss selling a house, or tour available homes for sale.